What is Bitcoin?

Bitcoin is a unit of currency that is used for store & transmit value among participants in the bitcoin network.

Users can transfer the bitcoin over the network to do just anything that can be done with conventional currencies , such as buy & sell goods , send money to people or organisations,or extend credit.Unlike traditional currencies bitcoins are entirely invisible.

History of Bitcoin

Bitcoin was invented in 2008 by Satoshi Nakamoto with the publication paper titled "Bitcoin: A peer-to-peer Electronic Cash System".

The bitcoin network started in 2009, based on a reference implementation published by Nakamoto & since revised by other programmers .

The largest transaction processed so far by the network was $150 million US dollars , transmitted easily without any fees.

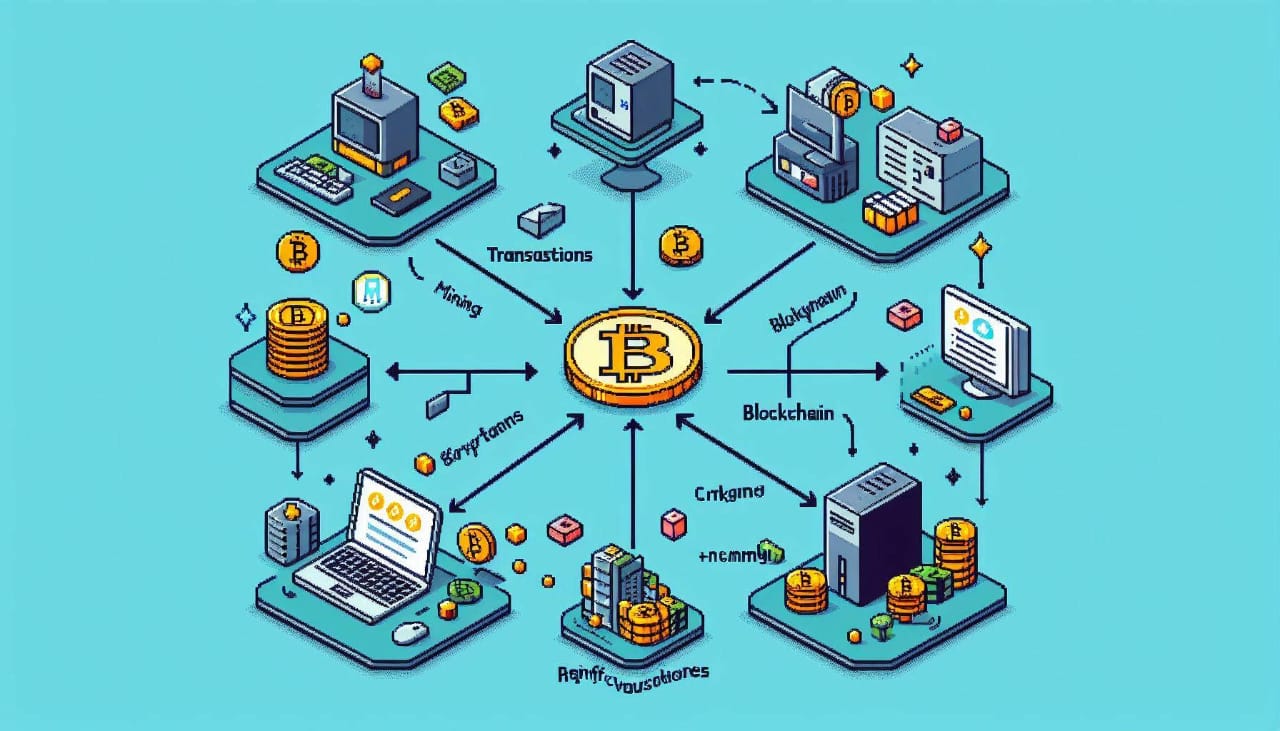

Uses Of Bitcoins:

five common uses of Bitcoin:

-

Investment: Many people buy Bitcoin as a long-term investment, hoping that its value will increase over time, similar to investing in stocks or precious metals.

-

Online Purchases: Some online merchants and service providers accept Bitcoin as a form of payment. It offers a decentralized and borderless way to make transactions without relying on traditional banking systems.

-

Remittances: Bitcoin can be used for international money transfers, especially in regions where traditional banking infrastructure is lacking or expensive. Bitcoin transactions can be faster and cheaper compared to traditional remittance services.

-

Hedging against Fiat Currency: In countries experiencing hyperinflation or economic instability, some individuals use Bitcoin as a hedge against their national fiat currencies, seeking to preserve their wealth.

-

Store of Value: Bitcoin is often referred to as "digital gold" because, like gold, it can serve as a store of value outside of government control. Some people hold Bitcoin as a hedge against economic uncertainty or as a way to diversify their investment portfolios.

Comparison between Bitcoin & traditional currencies

| Aspect | Traditional Currencies | Bitcoin |

|---|---|---|

| Issuance | Central banks and governments control issuance. | Decentralized issuance with a capped supply. |

| Control | Centralized control by governments and financial institutions. | Decentralized control by a global network of users. |

| Transaction Fees | Transaction fees may vary and are often applied by banks or payment processors. | Bitcoin transaction fees vary based on network demand. |

| Transparency | Transactions are recorded by banks and financial institutions, but transparency can vary. | Public ledger provides transparency for all transactions. |

| Security | Relies on trust in banks and financial institutions. | Relies on cryptographic algorithms and decentralized consensus. |

| Transfer Speed | Transfer speed depends on banking systems and can be slower for international transfers. | Bitcoin transactions can be slower during periods of high demand. |

| Accessibility | Accessible through banks, ATMs, and digital payment platforms. | Accessible globally via the internet and digital wallets. |

| Anonymity | Transactions are not completely anonymous and can be traced by authorities. | Bitcoin transactions can be pseudonymous but are recorded on a public ledger. |

| Inflation Resistance | Susceptible to inflation and controlled by central banks. | Designed to be resistant to inflation with a capped supply of 21 million coins. |

| Volatility | Generally stable compared to Bitcoin, but can still experience fluctuations. | Known for its price volatility due to market demand and speculation. |

Benifits of Bitcoin

- Store of Value: Bitcoin is often referred to as ‘digital gold’ because it is accepted as a store of value by many investors, particularly during inflationary times.

- High Returns: Historically, Bitcoin has provided outsized returns, outperforming other asset classes over the last decade. Self-Custody: Users can have complete control over their Bitcoin without relying on banks or other intermediaries.

- Decentralization: Bitcoin operates on a decentralized network, which reduces the risk of a single point of failure and makes it difficult for any organization or government to control or attack the network.

- Security: Bitcoin’s public key cryptography ensures the authenticity of transactions, and its decentralized nature protects against manipulation.

- 24/7 Availability: Unlike traditional financial markets, the Bitcoin network operates 24/7, allowing for continuous trading and transactions.

Conclusion

In conclusion, Bitcoin stands as a revolutionary digital currency, offering a decentralized and borderless alternative to traditional fiat currencies. Its inception in 2008 marked a significant milestone in the evolution of financial systems, providing users with a peer-to-peer electronic cash system that operates without the need for intermediaries like banks or governments.\

Bitcoin's versatility extends beyond its role as a medium of exchange; it serves as a store of value, an investment asset, and a hedge against economic uncertainty. Its decentralized nature, limited supply, and cryptographic security make it an attractive option for investors seeking to diversify their portfolios and protect against inflation.\

Moreover, Bitcoin's underlying technology, blockchain, ensures transparency, immutability, and resilience against manipulation. Its 24/7 availability and global accessibility further contribute to its appeal, enabling seamless transactions and trading activities across borders and time zones.

While Bitcoin's journey has been marked by volatility and regulatory challenges, its resilience and growing adoption demonstrate its potential to reshape the future of finance. As we continue to witness advancements in blockchain technology and the broader cryptocurrency ecosystem, Bitcoin remains at the forefront, driving innovation and empowering individuals with financial sovereignty.